Column by Martin Fedorko

Across Central Pennsylvania, new companies are being launched every day. From labs in State College to garages in York, the entrepreneurial spark is alive and well. The harder part isn’t getting companies started. The harder part is keeping them here long enough, and strong enough, to scale.

That’s where the foundation for a durable innovation economy is won or lost.

The first mile and the second mile

Central Pennsylvania has built real strength in the “first mile” of entrepreneurship. Founders can find pitch competitions, small grants, incubators, accelerators and university programs to help get an idea off the ground. That’s important. It’s how the spark of a good idea starts to catch fire.

But the real test comes in the “second mile,” when companies need to prove repeatable sales, attract outside capital to invest in their operations and scale up beyond their first customers. This is where too many startups still stumble. Without the right regional support systems — capital, infrastructure, talent density and visibility — companies hit a wall. Some move away. Some stall. Too few make the leap to becoming durable, growing companies that remain headquartered here.

If Central Pennsylvania wants to be known not just for starting companies, but for scaling them here, then the second mile is where our innovation economy must focus.

The chicken-and-egg challenge of capital

This challenge shows up most clearly in how early-stage risk capital flows into our region.

Private investment often seeks to support local endeavors — but in areas where the startup ecosystem is still developing, the pool of truly investable companies is too limited for this approach to work. On the other hand, if a venture capital fund’s thesis is drawn too narrowly — limited to a single county or a handful of zip codes — it becomes almost impossible to raise enough capital to operate effectively and achieve the returns needed to attract more capital.

That is the chicken-and-egg problem: without sufficient scale, an ecosystem can’t support a fund large enough to invest with discipline, cover operating costs, and establish a track record. But without establishing a track record, a VC firm can’t earn the confidence of outside investors who can bring exponentially more capital to the region.

The only way out of the loop is to think regionally and collaboratively. Central Pennsylvania cannot afford to shortchange itself by staying siloed. Regional connectivity is the only way to bring in the depth of capital that will move the needle. When we choose to work together, this chicken-and-egg problem can become a flywheel. Each disciplined investment creates wins, wins build confidence, and confidence attracts more capital. And that capital, in turn, strengthens the foundation for the next generation of founders to follow.

Why the standard matters

This is exactly what’s been happening in Central Pennsylvania. 1855 Capital, which began investing in 2017, and White Rose Ventures, which launched the White Rose Impact Fund in 2021, have together started to turn this flywheel.

Both funds are return-first, and that matters. White Rose Ventures does not invest in companies simply because they are local. We invest when they meet the bar that any company, in any market, would be expected to clear. By backing quality founders and showing that they can perform, both of these Central PA venture firms have been steadily building the confidence needed to attract more capital to our region.

One of the unique advantages White Rose Ventures and 1855 Capital offer is a bridge for this region’s institutional investors who previously had little reason to invest locally. Before, they often didn’t know where to find the deal flow or how to qualify the prospects. By creating visibility and providing disciplined vetting, we’ve given these investors a clear path to back Central Pennsylvania startups—opening up capital and networks that were previously out of reach.

Visibility, infrastructure, and progress

However, a track record of successful startup investments alone isn’t enough. Visibility and infrastructure are just as critical to repeated startup ecosystem success, because investors can’t invest in companies they don’t know exist. Every introduction, every pitch competition, every tech networking event, every co-investment ALL helps to build visibility. And visibility compounds.

Infrastructure is what keeps companies rooted here. That means lab space, technical support, talent pathways, and founder development programs. Facilities like the Center for Innovation & Entrepreneurship at Harrisburg University, Penn State’s 23 LaunchBoxes across its statewide Commonwealth campuses, and community incubators from York to Erie are all helping create that backbone. They don’t just help founders launch. They provide the scaffolding needed to keep building when the problems get harder.

We’ve already seen how this foundation can work. In five years, the Center for Innovation & Entrepreneurship has incubated more than 18 companies, creating a stronger pipeline of second-mile-ready startups. White Rose Ventures has invested in 13 startups across Central Pennsylvania, many of which have gone on to attract outside capital. 1855 Capital’s portfolio shows the power of Penn State intellectual property to commercialize successful spinouts, when supported by disciplined funding and guidance.

Not every company is ready for investment, nor should every company receive it. But through these combined efforts, there are more investable companies in Central Pennsylvania today than there were just a few years ago. Every time that bar is met, the entire ecosystem benefits.

What comes next

Momentum is building. Billions of federal research dollars flow into Pennsylvania’s universities every year. Private infrastructure commitments are reshaping the physical landscape for innovation. A new wave of AI, robotics, and advanced manufacturing is creating opportunities where Central Pennsylvania has natural strengths. And partnerships are beginning to cross regional lines in ways they haven’t before.

Five years ago, this alignment felt out of reach. Today, it is right on the horizon. The foundation for scale is being laid. Trust is being earned. And capital is starting to take notice.

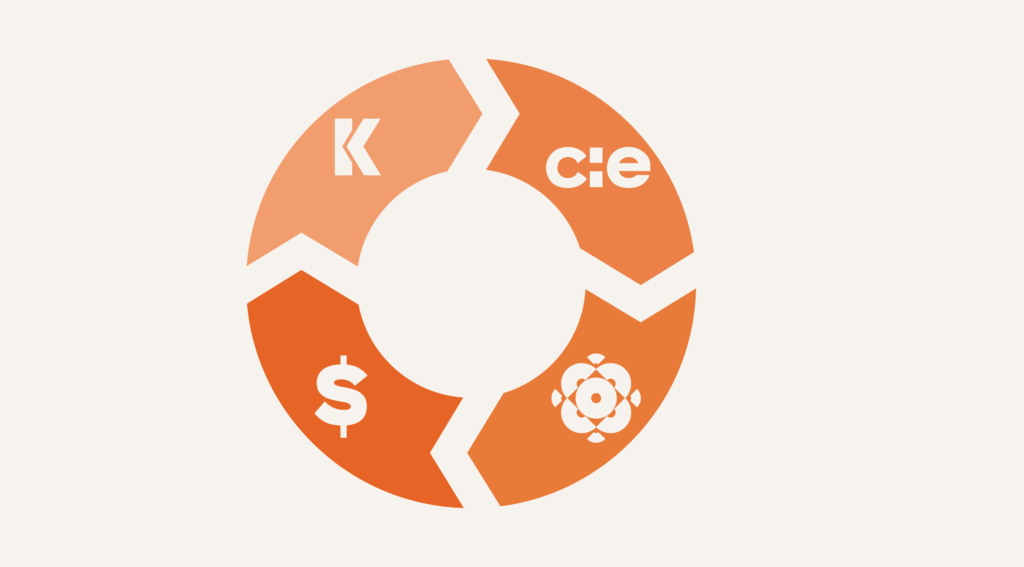

What comes next is the need for a true platform — one that rests on three pillars:

- Track record that builds confidence

- Visibility that attracts more investors

- Infrastructure that keeps companies here

That is how the flywheel continues to build momentum. That is how Central Pennsylvania puts itself squarely on the map. And that is how we make sure our companies are not just launched, but scale up, remaining headquartered and grown, right here.

Martin Fedorko is managing partner of White Rose Ventures

White Rose Ventures (WRV) is a York-based venture capital firm focused on fueling early-stage innovation and is the capital partner of a new collaborative initiative. 1855 Capital is a State College-based venture firm with a deep commitment to university-derived innovation. Together, WRV and 1855 Capital will be managing the Keystone Innovation Fund II, an investment vehicle set to begin investing in high-potential Pennsylvania startups towards the end of 2025.

The Center for Innovation & Entrepreneurship (CIE) is a Harrisburg-based incubator that provides structured guidance, curriculum, and founder development, acting as a commercialization engine for promising ideas and technologies. The LaunchBox & Innovation Network comprises 23 dedicated entrepreneurial support and program spaces, open to the public, and spanning Penn State University’s Commonwealth campus communities all across the state. Ben Franklin Technology Partners, with support from the PA Department of Community and Economic Development, is a state-backed provider of critical early-stage investment funding for PA technology companies, as well as business and technical expertise and resources.

Executives Insights is a new feature from biznewsPA. It provides local business executives and leaders a platform for sharing advice and perspective with the business community of Central Pennsylvania. If you are interested in contributing an executive insight, email [email protected].